What Is In Pre-Trade Analytics?

- Estimated Trading Cost

- Volume Profiles

- Market Metrics

What Is Estimated Trading Cost Analysis?

Let’s Take An Example

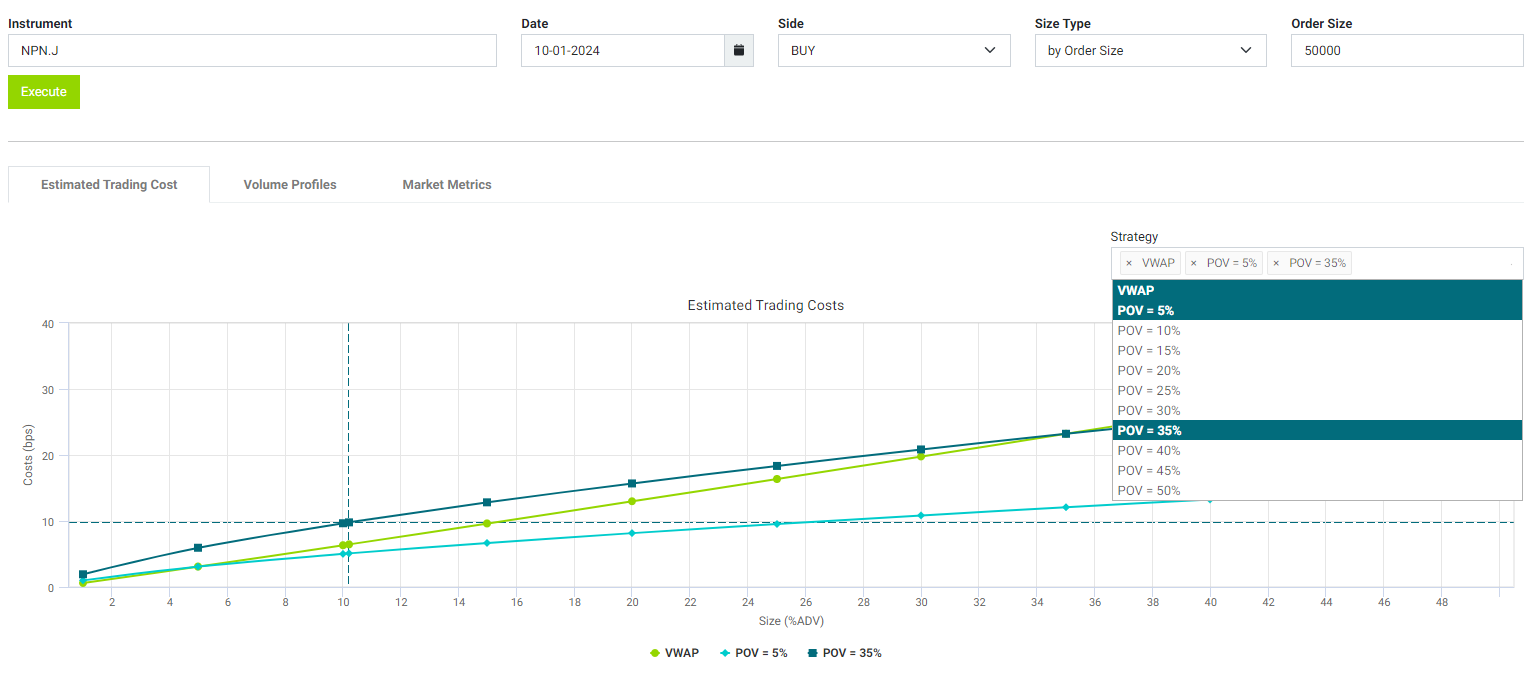

In the example below, the user has elected to analyse an order to BUY 50,000 NPN.J. They can also select a given % of ADV. The Expected Cost Impact model is then executed, and displays the results based on three default strategies (many more strategies are available as you can see in the drop down):

- VWAP;

- Participation Rate of 5% of volume;

- Participation Rate of 35% of volume.

The JSE Trade Explorer presents the results as the Expected Price Impact in bps (y axis) for a given %ADV (x axis). The dotted ‘cross-hairs’ show that an order for 50,000 shares of NPN.J is approximately 10.2% of ADV and the expected cost of trading at 35% of volume (dark blue line) is around 9.8bps. Meanwhile the expected cost of trading at 5% of volume (light blue line) is around 5bps, while a VWAP strategy (green line) is a little higher. By hovering over the graph with the mouse, the user can see the expected cost for any point on the curves.

More on Pre-Trade Analytics

How To Access the Service

If you are an existing user of the JSE Trade Explorer, please follow this link and login using your existing credentials: https://jse.big-xyt.com/login

If you are a new user, please register for the service by following this link https://jse.big-xyt.com/signup and follow the instructions.

Feedback, Suggestions and Support

Please send feedback, questions or issues to [email protected] or use the form on the “Contact Us” link in the footer of all user views. We would appreciate as much information as possible such as:

- name of the window,

- any non-default filter settings,

- date range,

- symbol or stock selected.